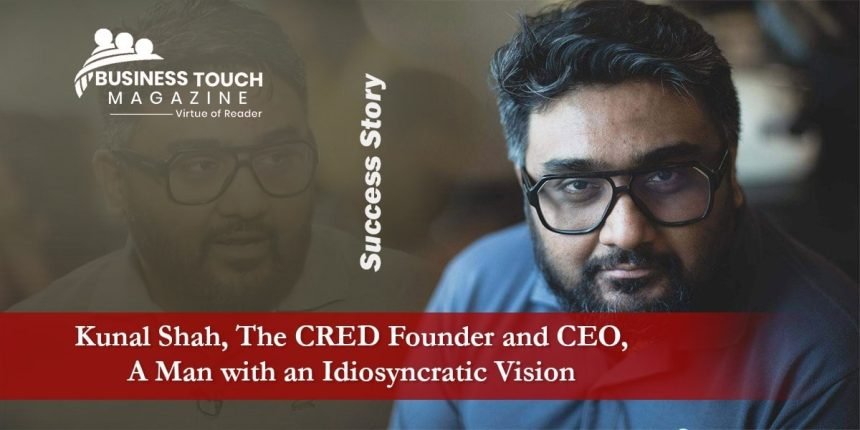

Founder & Chief Executive officer, Cred Kunal Shah is among several Indian entrepreneurs who have launched new ventures for the second time. An MBA dropout from Mumbai’s Narsee Monjee Institute of Management Studies, Shah had earlier launched ventures such as PaisaBack, a cashback and promotional discount campaign platform for retailers. But he shut down PaisaBack to set up FreeCharge in August 2010 along with Sandeep Tandon.

The startup was acquired by Snapdeal in April 2015. After the acquisition, FreeCharge continued to be run as an independent entity under Shah’s leadership. He, however, left the firm in October 2016. Subsequently, in July 2017, Axis Bank acquired FreeCharge. Kunal’s second stint at entrepreneurship comes a little over two years after he stepped down as the chief executive of FreeCharge.

After exiting FreeCharge, Shah dabbled into various things, but the entrepreneurial itch made him come back and create CRED. He believes if one has built and created all his life, the idea of not creating does not work. What is it that brings entrepreneurs back into the grind once they have created a successful start-up and followed that up with a fine exit for those involved?

“If you have built and created all your life, the idea of not creating is never a good idea,” says Kunal Shah, founder of FreeCharge and CRED.

Kunal Shah Early Life

Kunal Shah was born on 20 May 1983 in Mumbai, Maharashtra into a Gujarati family. His father was a businessman and his mother worked in the insurance sector. From a young age, Kunal used to help his father in his business. He has a brother, Rohan Shah. While in his 12th grade, Kunal got introduced to the internet. But during that time, the internet was very expensive and so, he decided to teach about the internet in a few internet institutes so that he can get free access to the internet. So, Kunal started working part-time in the institutes and in addition to the salary, he was also enjoying the free internet access.

The internet broadened his horizons as he started connecting and exchanging ideas with the academics in foreign universities. Later, Kunal quit his Data Entry job and moved full-time to teaching at several internet institutes and there, he used to surf the internet all night. He got addicted to reading articles on the internet but before this, he wasn’t a big fan of reading. In 1994, Kunal joined Wilson College, Mumbai to study for a Bachelor of Arts (B.A.) in Philosophy. He graduated in 2000. Later, Kunal started operating a BPO company.

Then, in 2003, he joined Narsee Monjee Institute of Management Studies (NMIMS), Mumbai to study part-time MBA but dropped out after a couple of semesters. Kunal didn’t like studying MBA because it focused more on memorising and writing rather than providing practical education. So, he decided to read the theory of MBA from the internet rather than attending classrooms. But the silver lining was that MBA introduced Kunal to the subjects of marketing and consumer behaviour.

His father’s pharmaceutical distribution business wasn’t doing well and as a consequence, they suffered a financial crisis. This forced him and his family to shift to living in a very small apartment. Kunal was 15 at that time and decided to take up a job to pay for his school fees and also lessen the financial burden on his parents. He started working as a Data Entry Operator and since then, he became financially independent.

A man who refused to follow, but lead

Even if you’re a rookie in the business world or an experienced entrepreneur, you know how hard it is to break the traditions and pave your path. But Kunal went against his family’s trend of joining the pharmaceutical sector, to start something of his own. After completing his graduation, he joined TIS International Inc., a start-up BPO, as a junior programmer. That gave him a kick-start as it was when Sandeep Tandon, a major stakeholder in the firm, noticed the potential shah projected.

His work spoke volumes for him, so much so, that he got promoted to the Business Head. Kunal also did his best and made the business grow to 1200 solid outsourcing teams in his 10-year stint at the firm (2000-2010). When Kunal realized that he wanted to start his entrepreneurial career, his former employer Sandeep helped fund his aspirations, and they together gave birth to Freecharge.

The Entrepreneurial Bug

The entrepreneurial bug bit him quite early in his career, and his many ventures are its results. Let’s peep into his list of ventures and understand the business ideas of each.

1. PaisaBack

The web portal tied up with big online retailers and directed customers to them in return for a good commission. The customers got a great deal on their purchases, including discounts and cashback and the retail websites got significant traffic.

2. Freecharge

The idea capitalized around the word “Free,” where customers were given free coupons from reputed brands like KFC, Barista, PVR Cinemas, and more if they perform an online bill payment or recharge. The idea was a win-win for many brands, and it featured Freecharge on top-notch websites like Rediff, The Hindu, and ET now to make their success story.

3. CRED

An Indian fintech company that allows users to make their credit card payments via the CRED app. It has many additional features of house rent payment and reinvests users’ money on different platforms. Even though the peculiar business model has struck quite a criticism from tech experts, the current valuation stands at $2.2 billion.

It is a financial services startup that offers credit products to consumers in India. The company was founded in October 2016 by Kunal Shah and their co-founder. The company’s mission is to make credit more affordable and accessible in India. The company started with a bang, raising $15 million in seed funding from Sequoia India and other investors in just six weeks. In the two years since then, Cred has grown rapidly, raising $90 million in Series A and B funding rounds.

The startup is now one of the most well-funded fintech startups in India, with a valuation of over $500 million. The company has over two million users and is on track to become profitable by 2020. This startup’s success lies in its focus on customer experience. The company has built a mobile app that makes it easy for users to track their credit scores, pay their bills on time, and apply for loans. Cred also offers rewards and discounts to customers who use its app regularly. It is changing the face of financial services in India and is poised for even greater success in the years to come. If you’re looking for a good credit option, be sure to check out Cred!

Considering that CRED’s target demographic is much smaller than those building fintech products for everyone, would scaling be a problem?

“Yes, and no,” says Shah. “If I was trying to create a company that has 500 million customers for the sake of having it, then yes but if you look at pure consumption, 50-60 per cent of the consumption of India comes from 10-15 million households, so the question then remains, am I going for a market that is small or I am going for a market that is a market.”

There are multiple avenues of growth going forward for CRED, says Shah.

“We made a choice that we will do everything that helps improve financial progress for our customers and every such step we help them take is a potential monetization step,” he says.

In a few years, Shah sees CRED as a community of 10-12 million customers who don’t just use the product or service being offered but also interact with each other, improving their lives.